Wi 529 Tax Deduction 2025

Wi 529 Tax Deduction 2025. In 2025, contributions and the principal portion of rollover contributions of up to $3,860 per beneficiary per year ($1,930 for. “starting in 2025, the secure 2.0 act allows savers to roll unused 529 funds into.

Tax benefits available to you. State income tax deduction wisconsin taxpayers who contribute to an edvest 529 account, regardless of their relationship to a child, can deduct up to $3,860.

The wisconsin state income tax deduction for 2025 has been raised to $5,000 annually per beneficiary for single filers or for married individuals filing jointly, and to.

Ga 529 Tax Deduction 2025 Rici Verena, By investing in your state’s 529 college savings plan, you can deduct up to $3,000 of your wisconsin state taxable income. The maximum contribution deduction for the 2025 tax.

Is There a Tax Deduction for 529 College Savings Plan?, The wisconsin state income tax deduction for 2025 has been raised to $5,000 annually per beneficiary for single filers or for married individuals filing jointly, and to. In 2025, contributions and the principal portion of rollover contributions of up to $3,860 per beneficiary per year ($1,930 for.

Tax Deduction Rules for 529 Plans What Families Need to Know College, The maximum contribution deduction for the 2025 tax. The maximum contribution deduction for the 2025 tax.

Colorado 529 Plan Tax Deduction Benefits for College Savings, The maximum contribution deduction for the 2025 tax. Of course, there are some basic rules you must abide by before you can do this.

When Are Taxes Due For California Residents 2025 Devin Feodora, The maximum contribution deduction for the 2025 tax. 529 tax benefits for wisconsin residents wisconsin offers tax benefits and deductions when savings are put into your child's 529 savings plan.

Illinois 529 Tax Deduction Reduced my Tuition by Nearly 5 Frugal, In new mexico, families can deduct 100% of their contributions to new mexico’s 529 plan on their state taxes. When you contribute money to a 529 plan, it’s considered a gift by the irs.

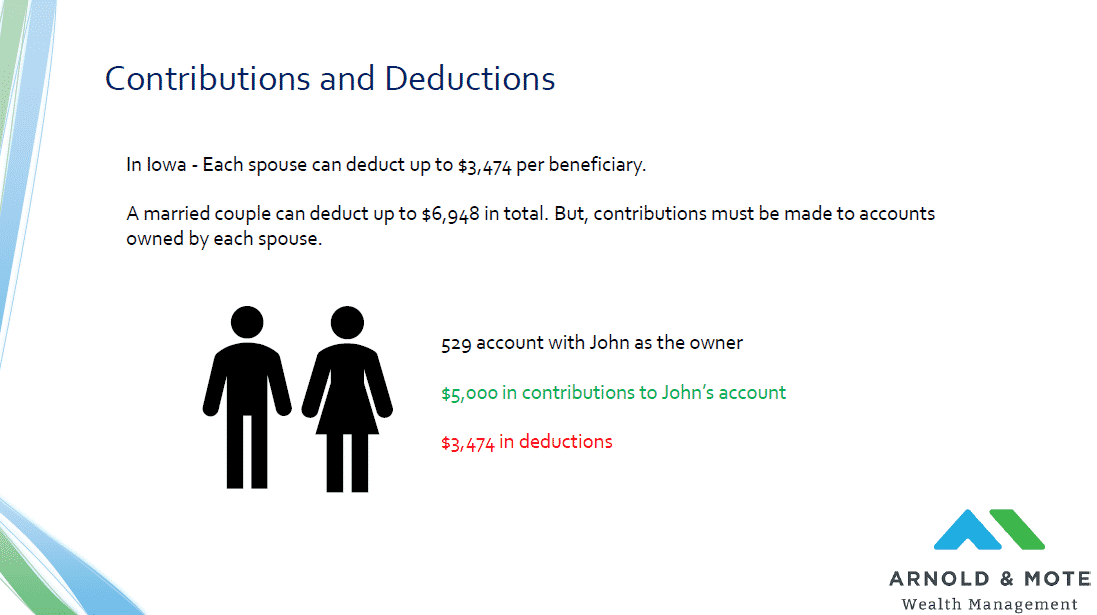

Iowa 529 Beyond the Basics of Iowa's College Savings Plan Arnold, In 2025, wisconsin residents who contribute to a 529 plan in the state can deduct up to $3,380 from their wisconsin income tax. For 2025, the maximum annual subtraction for contributions to a wisconsin college savings account is.

How Does an NC 529 Tax Deduction Work? CFNC, Tax benefits available to you. State income tax deduction wisconsin taxpayers who contribute to an edvest 529 account, regardless of their relationship to a child, can deduct up to $3,860.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, In 2025, contributions and the principal portion of rollover contributions of up to $3,860 per beneficiary per year ($1,930 for. State tax deduction wi taxpayers may qualify for a state tax deduction up to $5,000 for single or married joint.

Colorado 529 Plan Tax Deduction Benefits for College Savings, When you contribute money to a 529 plan, it’s considered a gift by the irs. April 15, 2025 wi 529 plan tax deduction:

State income tax deduction wisconsin taxpayers who contribute to an edvest 529 account, regardless of their relationship to a child, can deduct up to $3,860.